Baby Care Children’s products market in Vietnam

19/11/23 10:42 sáng | Luợt xem : 684

Children’s products market in Vietnam

Vietnam’s baby products market [1] is growing significantly, driven by rising disposable income, urbanization, and growing parental awareness of children’s health and safety. In addition, young families in urban areas are investing more in premium and high-quality baby products, reflecting the changing priorities of consumers.

Vietnam Baby Products Market Overview

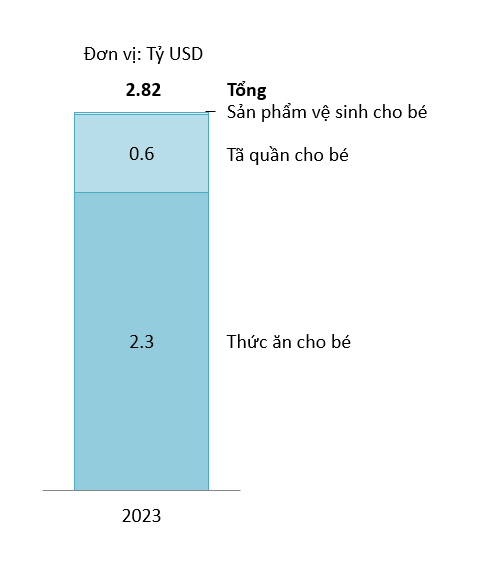

Vietnam’s baby products market is growing dynamically across categories such as baby food, diapers, hygiene products, clothing, toys, and children’s furniture. The baby food industry alone is expected to be worth US$2.3 billion by 2023[2]. In addition, diapers and baby hygiene products are also witnessing growth, reaching a total of US$557 million [3] and US$15 million [4].

Outstanding Vietnamese Children’s Products (2023)

Vietnam’s economy has been steadily recovering from the Covid-19 pandemic, leading to an increase in disposable income, especially in urban areas where their monthly salaries in 2023 are expected to increase by 11% compared to 2018. [5] The urbanization rate in Vietnam is also quite high at 42% in 2023. [6] These have driven the demand for premium and organic baby products as parents prioritize the health and safety of their children, in line with the global trend towards sustainable and health-conscious consumption despite the relatively high prices.

Baby products are displayed in stores.

However, despite the growth of the children’s product market in Vietnam, the number of children aged 0-5 has shown a clear downward trend. From 2019 to 2023, the population of children under five in Vietnam decreased by 10% and is expected to continue to decline over the next five years [7]. This decline signals that the children’s product market in Vietnam may be approaching saturation point, posing potential challenges for future growth.

Main competitors in the children’s products segment

Most baby products in Vietnam come from international markets, offering a wide range of products and categories. Notably, brands from Japan and the United States have become very familiar and widely favored by Vietnamese consumers, with prominent names such as Abbott, Johnson & Johnson, Bobby and Meiji. Among domestic companies, Vinamilk stands out as a Vietnamese brand that can compete with these international giants. In the baby food segment alone, Vinamilk holds an impressive 20%[8] market share, second only to Abbott. Interestingly, the price difference between domestic and foreign brands is not significant. However, international brands often take advantage of economies of scale to offer more diverse and affordable product options than their domestic competitors.

When it comes to retail, Con Cung, Bibo Mart and Kids Plaza dominate the Vietnamese market, with a strong presence mainly in major cities such as Hanoi and Ho Chi Minh City. While most retailers are still concentrated in urban areas, Con Cung has leveraged its considerable resources and foreign investment to establish branches across Vietnam’s provinces. This extensive reach has given Con Cung a significant competitive advantage, making it difficult for other retailers to match its scale and presence.

Some popular baby product retailers

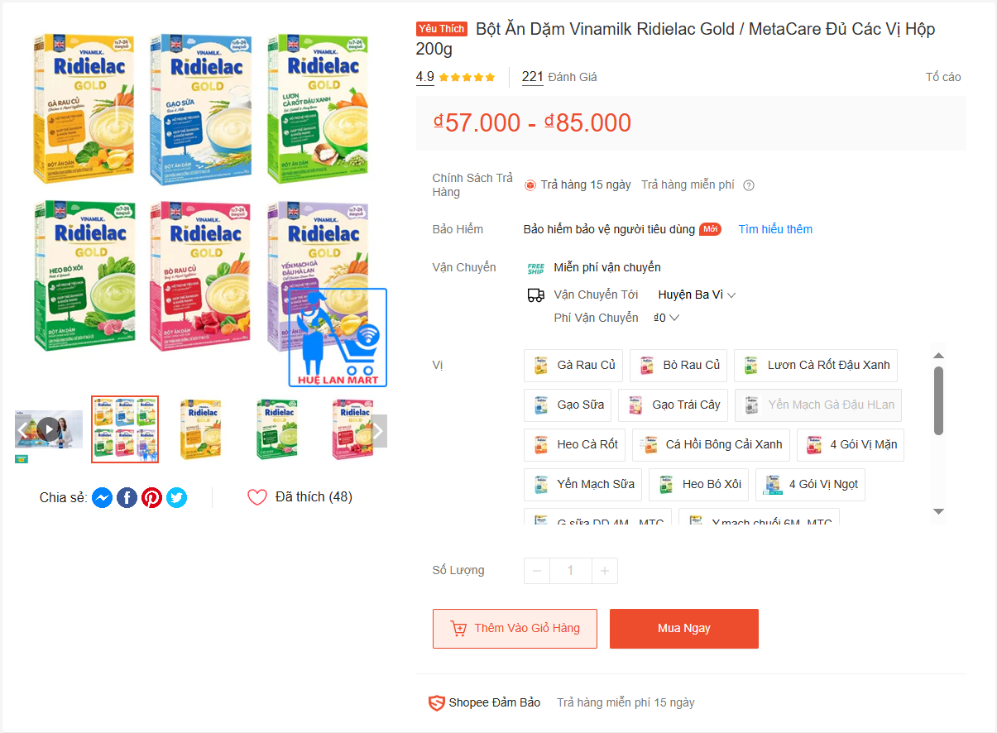

Beyond physical stores, the rise of e-commerce platforms such as Shopee, Lazada and Tiki has transformed the market, giving parents across Vietnam easy access to a wide range of products. This digital revolution has also opened up opportunities for smaller brands or retailers that cater to specific consumer needs, such as organic or hypoallergenic products.

Example of baby products on Shopee (E-commerce Platform)

Opportunities and challenges for the market

As urbanization accelerates and disposable incomes increase, demand for high-quality, safe and sustainable products will increase. The baby food market is expected to have a CAGR of 7% over the next five years, from 2023 to 2028. [9] Niche markets, such as hypoallergenic skincare products or baby food inspired by local flavors, also have significant potential. Additionally, the growing popularity of e-commerce opens up another avenue of growth, allowing brands to reach a wider audience at a relatively low cost. International investments are on the rise, with foreign companies increasingly recognizing Vietnam as a high-potential market for baby products.

Despite its rapid growth, the market still faces a number of challenges. (i) Price sensitivity remains a significant concern, especially among middle-income families who prioritize affordability over premium options. (ii) The presence of counterfeit products poses another issue, with baby food and formula being the most prevalent in the market, undermining consumer confidence and posing safety risks to children [10]. (iii) In addition, the market has many competitors with a wide range of products, some of which have become well-known and familiar brands to Vietnamese people.

Therefore, to address these challenges, companies that focus on affordability while maintaining quality are likely to capture a significant market share. With baby product retailers such as Con Cung, Bibo Mart and Kids Plaza already setting up shop across the region, foreign investors may want to consider partnering with local retailers to drive further growth, raise brand awareness and introduce new products. Furthermore, the emphasis on organic, eco-friendly or unique flavours is expected to drive future consumer preferences, shaping the direction of the industry in the coming years.

Conclude

Vietnam’s baby products market is a dynamic and growing sector, driven by rising disposable incomes, urbanization, and consumer preferences for premium and sustainable baby care products. While challenges such as price sensitivity, counterfeiting, and economic disparity persist, the opportunities are equally compelling. The growing popularity of e-commerce, niche product categories, and partnerships with established local retailers provide avenues for innovation and expansion. Companies that prioritize quality, affordability, and sustainability will be well-positioned to thrive in this dynamic and promising market.