Vietnam mother and baby market

19/11/23 10:30 sáng | Luợt xem : 466

Vietnam’s mother and baby market & the ambition of the big guys to dominate the market share

According to the General Statistics Office, as of 2019, Vietnam had 24.7 million children, accounting for 25.75% of the country’s total population, and about 24.2 million women of childbearing age (from 15 to 49 years old). In addition, with about 1.5 million children born each year, along with increased spending power and the trend of preferring domestic products among parents. With this characteristic, Vietnam is a potential market for businesses providing products and services related to mothers and children.

On the other hand, according to Euromonitor, revenue from Vietnamese mother and baby products (including baby food, products specifically for children and children’s clothing) reached about VND 50,100 billion in 2021 and is expected to grow by about 7.3% per year in the period 2021-2025. However, the market share of modern retail chains for children’s products is only about 20% and the remaining 80% belongs to small stores. This has attracted the participation of the big retail giant, Mobile World.

The mother and baby market has achieved steady growth in recent years despite the pandemic. In particular, as consumers’ shopping habits have shifted from the traditional model of markets and supermarkets to a chain of products specifically for mothers and babies more and more clearly. That is also the reason why in recent years, businesses and investors, especially foreign investors, have continuously poured capital into the mother and baby market, making this field more vibrant than ever before.

Typically, the strong attack and rise of a series of names such as Bibo Mart, Kids Plaza, Con Cung, Shoptretho, TutiCare… Along with the presence of domestic names, foreign companies are also looking to penetrate the Vietnamese market such as: the Japanese brand Soc&Brothers or the British brand Mothercare.

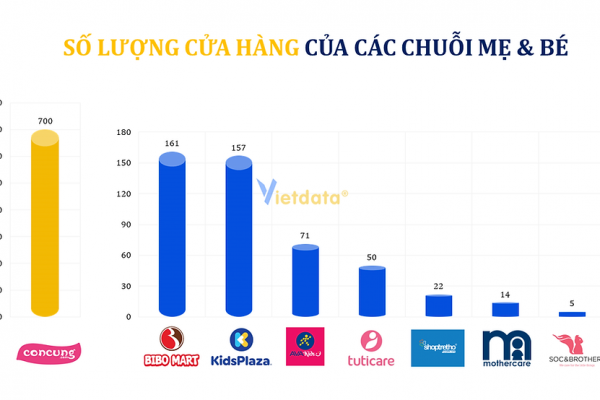

Significant growth in the number of stores

In recent years, mother and baby stores have sprung up more and more. We can easily see mother and baby stores with familiar brands such as Con Cung, Bibo Mart, Shoptretho, Kids Plaza, … with a grand scale located right on the frontage of major streets.

Up to now, Con Cung is the leading unit in the mother and baby products market. Updated on the website, Con Cung currently has 700 supermarkets nationwide. The company has 3 retail chains of goods for pregnant mothers and babies including Con Cung, Toycity, CF (Con Cung Fashion).

The store systems of other brands are also constantly expanding. Currently, the Bibo Mart chain owns 161 stores and is present in 33 provinces/cities. Followed by the Kids Plaza chain with 157 stores.

TutiCare’s store scale is also quite large with 50 large and small stores across the country. Next is Shop Tre Tho, with the first store opened in Hanoi, up to now this system has more than 22 stores operating in major cities, of which the most developed is the branch in Ho Chi Minh City.

The British brand – Mothercare currently has 14 retail stores nationwide under the exclusive distribution of European Fashion and Cosmetics Company Limited (ACFC) under the Imex Pan Pacific Group (IPP Group).

Soc&Brothers currently has 5 showrooms displaying and introducing products in a very large and modern scale. Here, customers will see a full range of products distributed by Soc&Brothers, always displayed richly, scientifically, and neatly in a brightly decorated space, with clear and cheerful music.

Earlier this year, the mother and baby products market became more exciting when it welcomed a new recruit from MWG Group – AVAKids. The chain of stores targets pregnant mothers and families taking care of young children. Although it is a latecomer, AVAKids has the advantage of having laid the foundation from before – experience in developing, operating and managing the chain from Mobile World Group. As of June, the chain reached 50 stores after 5 months of launching. Up to now, MWG has shown its determination by opening 71 AVAKids stores in Ho Chi Minh City and many neighboring provinces, including “super-wide” locations located on busy streets.

Thus, although MWG’s new chain has just entered the market, with the current expansion speed and the company’s goals for this year, AVAKids is likely to be able to catch up with the “big guys” in this potential market in terms of the number of stores.

The journey of players to conquer the billion-dollar market

CON CUNG

Con Cung Joint Stock Company is a pioneer in Vietnam specializing in products for children. The company’s fields of operation include: Developing retail chains for pregnant mothers & babies: Con Cung, Toycity, CF (CON CUNG FASHION). Researching and launching safe, quality, and reasonably priced products exclusively for children.

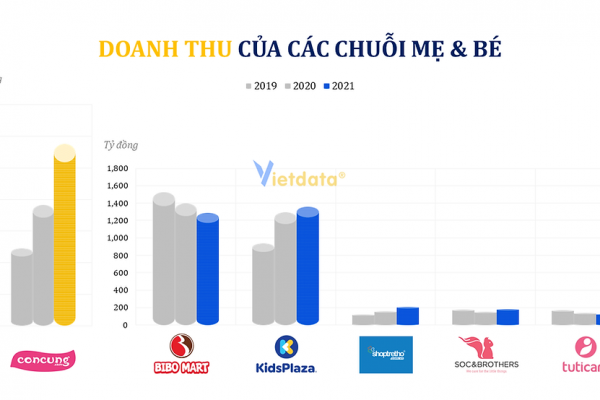

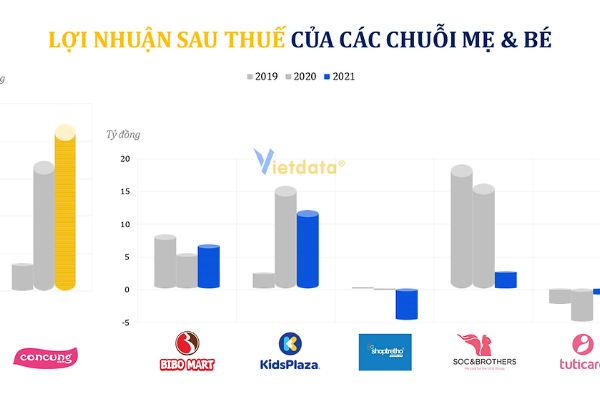

Con Cung is a chain of mother and baby stores that has recorded the strongest growth rate when it is the leader in the number of stores and revenue compared to other chains. Specifically, at the end of 2019, Con Cung achieved a revenue of nearly 2.5 trillion VND, but by 2021 it had increased to 5.7 trillion VND (an increase of more than 50% compared to the same period in 2020). After-tax profit also increased sharply from nearly VND15 billion in 2019 to nearly VND90 billion in 2021.

With the ambition of having 2,000 convenience stores and 200-300 supermarkets by 2025, Con Cung expects to reach a revenue milestone of USD1 billion in 2023 and capture 30% of the market share to achieve sales of USD2 billion in 2025, of which at least 30% will come from e-commerce.

BIBO MART

Established in 2006, the Bibo Mart Mother & Baby store chain is under the management of Bibo Mart TM Joint Stock Company. Bibo Mart specializes in providing products for mothers and babies from prestigious brands in the world such as: Combi, Chicco, Fisher-price, Farlin, Hipp, DrBrown… all of which are tested and certified to be safe for the health of mothers and babies.

Before the epidemic broke out, Bibo Mart’s chain of stores was doing very well and brought in more than 8 billion VND in after-tax profit, 7 times higher than in 2018. However, when the epidemic began to appear in Vietnam, the revenue of this system also slowed down.

Ms. Trinh Lan Phuong, CEO of Bibo Mart, said that at that time the company was restructuring to prepare for an IPO plan with the participation of leading experts from Amazon, Taobao, and Walmart.

KIDS PLAZA

Established in 2009, Kids Plaza provides more than 10,000 genuine products for Mothers and Babies, certified by the world as safe for children from the leading prestigious brands in Vietnam and the world.

Kids Plaza has also continuously affirmed its position in the race when the revenue of this giant has continuously increased over the years. Specifically, in 2019, the revenue of this Mother & Baby store chain reached nearly 940 billion VND and increased to nearly 1.4 trillion VND in 2021. However, profits are quite volatile, such as in 2019, the profit was only 2.5 billion VND, in 2020 it increased to 15.7 billion VND and in 2021 it decreased to 12 billion VND.

SHOP TRE THO

Established in 2009 with the first location at 623 Hoang Hoa Tham, Ba Dinh, Hanoi, Shop Tre Tho now has 22 stores operating in other cities, especially in Ho Chi Minh City.

After more than 10 years of establishment and development, Shop Tre Tho is one of the most prestigious suppliers of newborn products and products for mothers and babies in the Vietnamese market. This chain of stores provides more than 15,000 products and 500 major brands worldwide with diverse designs, safe quality, voted and highly appreciated by consumers.

In the past few years, the revenue of this chain of stores has also increased continuously, from about 120 billion VND in 2019 to more than 210 billion VND in 2021, although this system is still reporting losses. Accordingly, in 2020, Shop Tre Tho lost nearly 270 million VND and by the end of 2021 this loss reached nearly 5 billion VND.

SOC&BROTHERS

Established in 2007, Soc&Brothers has provided more than 20,000 diverse items for mothers and babies to household products, furniture, and health for families. Soc&Brothers is the exclusive representative in Vietnam of 6 famous brands in the world and only provides genuine, branded, reputable goods and especially has insurance for goods.

It can be seen that in recent years, the revenue of this chain of stores has fluctuated erratically. In particular, the after-tax profit of the Mother & Baby supermarket system has gradually decreased in the period 2019 – 2021. In 2020, Soc&Brothers recorded a revenue of about 150 billion VND, down nearly 15% compared to 2019. But by 2021, the revenue of this chain of stores reached more than 180 billion VND.

TUTICARE

TutiCare – The leading prestigious Mother & Baby store system in Vietnam, managed by VEETEX Joint Stock Company. TutiCare provides all newborn products, mother & baby supplies for the process from when mothers are pregnant, giving birth and taking care of their babies. This is the gathering place of selected, genuine brands for mothers & babies famous in the world, which have long been known and trusted by parents and babies around the world: Chicco, Phillips Avent, Munchkin, Combi, Braun, Aptamil, Nuk, Bubchen, Arau, Graco, Lego…

Like Shop Tre Tho, Tuticare’s business situation in recent years has not been very positive. Specifically, in the period of 2019 – 2021, the revenue of this chain of stores gradually decreased from more than 170 billion VND (in 2019) to about 125 billion (in 2021).

AVAKIDS

AVA Kids is a chain of stores specializing in selling products for mothers and babies that has just been launched by The Gioi Di Dong. The products sold mainly in the system include milk, diapers, foods, foods with clear origins, safe cosmetics, daily necessities, toys or fashion items, bicycles for children, etc.

The Gioi Di Dong is an “outsider” business in the industry because this unit is often known more in the field of retailing electronics and technology products. Although it started later than its big competitors, MWG is not willing to show its inferiority.

In particular, with The Gioi Di Dong’s wide chain ecosystem, it helps the chain of stores open more shops without facing many difficulties in terms of premises, as well as developing online sales channels. Along with that, taking advantage of The Gioi Di Dong’s huge loyal customer base helps AVAKids to take shortcuts and get ahead, without having to “follow” competitors.

In fact, the mother and baby industry in Vietnam is delicious but has many barriers. The proof is that many names that once made a name for themselves in this industry have quietly withdrawn from the market. These include Kids World, Deca, Beyeu, Babysol… The departure of once-famous brands shows that this is a fiercely competitive industry that requires high sensitivity.

Especially in recent times, when consumers have changed their shopping behavior from traditional markets to online shopping. Therefore, businesses in this industry need to invest in technology and have a digital vision to exploit this billion-dollar mother and baby consumer market.